Global Indices Strategic Fund (GISF) – Indices Trading Guide

- August 6, 2024

- Posted by: Drglenbrown1

- Category: Finance, Investments, Proprietary Trading

Overview

The Global Indices Strategic Fund (GISF) is designed to capture growth and yield opportunities within major global indices. This guide outlines the trading strategies, risk management practices, and operational procedures for the GISF. The fund targets strategic investments in a diverse range of indices, including but not limited to the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, and Nikkei 225.

Objectives

- Growth: Capture opportunities in high-growth sectors and markets.

- Yield: Generate consistent returns through diversified index investments.

- Risk Management: Maintain a balanced risk profile to protect capital.

Sub-Funds

The GISF consists of several sub-funds, each focusing on specific regions, sectors, or market conditions.

- GISF – US Growth and Stability Fund

- GISF – European Diversification Fund

- GISF – Asia-Pacific Dynamic Fund

- GISF – Global Emerging Markets Fund

- GISF – Sector Innovation Fund

Strategy

Multi-Faceted Approach

- Direct Index Investments: Invest directly in index funds and ETFs.

- Derivatives Trading: Utilize index futures and options for hedging and speculative purposes.

- Long, Short, and Spread Tactics: Employ various trading strategies based on market conditions.

Risk Management

Maximum Real-Time Risk

- Total Capital: $100,000

- Maximum Real-Time Risk: 2% of total capital ($2,000)

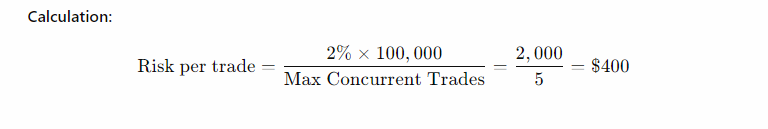

Risk per Trade

- Sub-Funds’ Risk per Trade: $400 (0.4% of total capital)

- Concurrent Trades: Up to 5 per sub-fund

Calculation:

Technological Integration

- Global Algorithmic Trading Software (GATS):

- Market Analysis: Analyzes market patterns, historical data, and economic indicators.

- Trade Execution: Optimizes trade timing and position sizing.

- Real-Time Monitoring: Continuously monitors market volatility and liquidity.

- Correlation Analysis: Assesses correlations between indices to minimize risk.

Performance Monitoring

- Benchmarks: Compare performance against MSCI World Index and customized indices.

- Analytics: Regularly review performance and adjust strategies as needed.

- Adaptability: Ensure strategies remain effective in changing market conditions.

Sub-Funds Strategies

- GISF – US Growth and Stability Fund

- Indices: S&P 500, Dow Jones Industrial Average, NASDAQ 100

- Focus: High-growth sectors (technology, healthcare) and stable blue-chip companies.

- Risk Management: Sector diversification and options strategies.

- GISF – European Diversification Fund

- Indices: FTSE 100, DAX 30, CAC 40

- Focus: High-growth sectors (technology, renewable energy) and stable dividend-yielding companies.

- Risk Management: Futures contracts for currency and geopolitical risk hedging.

- GISF – Asia-Pacific Dynamic Fund

- Indices: Nikkei 225, Hang Seng Index, ASX 200

- Focus: Emerging market sectors (technology, consumer goods) and established companies.

- Risk Management: Spread tactics and options strategies.

- GISF – Global Emerging Markets Fund

- Indices: MSCI Emerging Markets Index, FTSE Emerging Index

- Focus: High-growth sectors (technology, financials) in emerging markets.

- Risk Management: Derivatives for currency risk and market volatility management.

- GISF – Sector Innovation Fund

- Indices: Technology, Healthcare, Renewable Energy indices

- Focus: Innovative sectors with high growth potential.

- Risk Management: Diversification across sectors and regions.

Disclaimer/Notice

The Global Indices Strategic Fund (GISF) is an internal proprietary trading vehicle utilized by Global Accountancy Institute, Inc., and Global Financial Engineering, Inc. It is not open to the public and does not accept investments from external parties. The fund does not engage in any external financial advising or public deposit acceptance.

Implementation

Trade Execution

- Entry: Identify opportunities using GATS and enter trades within the allocated risk per trade.

- Stop-Loss: Implement stop-loss orders to limit risk to $400 per trade.

- Position Sizing: Adjust position sizes to ensure risk per trade does not exceed $400.

Real-Time Monitoring

- Risk Assessment: Continuously monitor the total risk across all open trades.

- Adjustments: Make necessary adjustments to maintain the 2% maximum real-time risk.

Regular Review

- Performance Review: Regularly evaluate the performance of each sub-fund.

- Strategy Adjustment: Adjust strategies based on performance analytics and market conditions.

Summary

The Global Indices Strategic Fund (GISF) is designed to capture growth and yield opportunities within major global indices while maintaining balanced risk management. Each sub-fund employs specific strategies to maximize returns within a controlled risk environment. By leveraging advanced technological integration and rigorous risk controls, the GISF aims to effectively manage internal capital and strategically engage with global market opportunities.

About the Author: Dr. Glen Brown

Dr. Glen Brown stands at the forefront of the financial and accounting sectors, distinguished by a career spanning over a quarter-century marked by visionary leadership and groundbreaking achievements. As the esteemed President & CEO of both Global Accountancy Institute, Inc., and Global Financial Engineering, Inc., he steers these institutions with a steadfast commitment to integrating the realms of accountancy, finance, investments, trading, and technology. This integrative approach has solidified their status as pioneering entities in global multi-asset class professional proprietary trading and education.

Holding a Doctor of Philosophy (Ph.D.) in Investments and Finance, Dr. Brown possesses profound expertise covering an impressive spectrum of financial disciplines. His knowledge extends from financial accounting and management accounting to intricate areas of finance, investments, strategic management, and risk management. As the Chief Financial Engineer, Head of Trading & Investments, Chief Data Scientist, and Senior Lecturer, Dr. Brown embodies the spirit of hands-on innovation and scholarly excellence.

Dr. Brown’s guiding philosophy, “We must consume ourselves in order to transform ourselves for our rebirth,” encapsulates his holistic approach to professional and personal development. It underscores a belief in the transformative power of self-reflection, creative imagination, and the relentless pursuit of spiritual and intellectual growth. This ethos is the bedrock of his dedication to not just navigating but shaping the future of finance and investments with innovative solutions.

Beyond his executive and academic roles, Dr. Brown is a fervent advocate for continuous learning and innovation. His leadership has catalyzed a culture of forward-thinking at Global Accountancy Institute, Inc., and Global Financial Engineering, Inc., propelling them into the vanguard of financial education and proprietary trading. Under his guidance, these institutions not only adapt to the evolving financial landscape but actively contribute to its development, offering state-of-the-art solutions to the industry’s most complex challenges.

In essence, Dr. Glen Brown is not just a leader but a pioneer, educator, and innovator whose life’s work continues to impact the global finance and accounting industries profoundly. His legacy is defined by the relentless pursuit of excellence, the transformation of challenges into opportunities, and the unwavering belief in the potential for rebirth and regeneration in the professional realm.

General Disclaimer

The Global Indices Strategic Fund (GISF) is an internal proprietary trading vehicle utilized by Global Accountancy Institute, Inc., and Global Financial Engineering, Inc. It is not open to the public and does not accept investments from external parties. The fund does not engage in any external financial advising or public deposit acceptance. The strategies and performance discussed herein are for informational purposes only and are not intended as investment advice. Trading in financial markets involves significant risk and may not be suitable for all investors. The results achieved by the GISF are not necessarily indicative of future performance.