Visionary Leadership in Financial Engineering: The Legacy of Dr. Glen Brown

- March 12, 2025

- Posted by: Drglenbrown1

- Category: Financial Engineering

In an industry where innovation is the key to survival and success, few individuals have left as indelible a mark as Dr. Glen Brown. As a pioneer in financial engineering and algorithmic trading, Dr. Brown’s visionary leadership has redefined how modern trading systems are designed, implemented, and refined. His groundbreaking work has not only transformed proprietary trading methodologies but has also set a new standard for risk management and multi-timeframe analysis in the financial markets.

The Genesis of a Visionary

Early Influences and Academic Foundations

Dr. Glen Brown’s journey into financial engineering began with a profound fascination for mathematics, statistics, and the underlying mechanics of financial markets. With an academic foundation built on rigorous research and a passion for quantitative analysis, he quickly recognized the limitations of traditional models. While many in the field remained entrenched in theoretical constructs, Dr. Brown envisioned a future where these theories could be translated into actionable strategies that respond dynamically to market conditions.

Bridging Theory and Practice

Where many saw abstract formulas and static models, Dr. Brown saw an opportunity to bridge the gap between theory and reality. He dedicated his career to developing innovative frameworks that could adapt in real time, transforming academic concepts into practical trading tools. His approach was not merely about building algorithms—it was about creating a holistic system where every element, from signal generation to risk management, worked in harmony to capture market opportunities and mitigate risk.

The GATS Framework: A Testament to Visionary Leadership

Revolutionary Integration of Multi-Timeframe Strategies

At the heart of Dr. Brown’s legacy lies the Global Algorithmic Trading Software (GATS) framework. This comprehensive system integrates a suite of trading strategies across multiple timeframes, from ultra-short-term scalping to long-term trend riding. By deploying nine distinct strategies tailored to different market conditions, GATS ensures that every trade is backed by a thorough analysis that encompasses both immediate price action and overarching market trends.

- Higher Timeframe Governance:

One of the hallmark innovations within GATS is the use of the Daily MACD as a trend governor. This higher timeframe filter validates short-term signals, ensuring that every trade aligns with the broader market direction—a principle that embodies Dr. Brown’s belief in rigorous, multi-dimensional analysis. - Adaptive Risk Management:

With tools such as the Dynamic Adaptive ATR Trailing Stop (DAATS) and Global Adaptive Time Scaling Factor (GTSF), the framework dynamically adjusts risk parameters in real time. This adaptive approach not only protects capital but also allows profitable trades to run, embodying the perfect balance between risk and reward.

Proprietary Innovation and a Closed Business Model

Dr. Brown’s leadership is also defined by his commitment to exclusivity and innovation. Under his guidance, Global Accountancy Institute, Inc. (GAI) and Global Financial Engineering, Inc. (GFE) operate as closed proprietary firms. This business model enables continuous research and development without external pressures, safeguarding intellectual property and ensuring a competitive edge. By not accepting external funds or clients, Dr. Brown maintains full control over the evolution of his trading systems, allowing for rapid adaptation and refinement in an ever-changing market environment.

Shaping the Future of Financial Engineering

Pioneering Adaptive Trading Systems

Dr. Brown’s legacy is not just confined to the development of advanced trading systems; it is also about inspiring a new generation of financial engineers to think beyond conventional boundaries. His work demonstrates that by merging academic rigor with practical innovation, it is possible to create systems that are not only resilient to market volatility but also capable of capitalizing on emerging opportunities.

- Holistic Market Analysis:

His emphasis on multi-timeframe strategies, adaptive risk management, and layered signal confirmation has redefined market analysis. These techniques empower traders to filter noise, validate trends, and execute trades with precision—principles that have become essential in today’s fast-paced markets. - Sustainable Innovation:

Dr. Brown’s focus on continuous improvement and research underscores the importance of sustainable innovation in financial engineering. His methodologies are designed to evolve as market conditions change, ensuring that his legacy remains relevant and influential for years to come.

Impact and Recognition

Over the years, Dr. Brown’s contributions have earned him widespread recognition as a thought leader and visionary in financial engineering. His frameworks are not only a testament to his technical prowess but also to his strategic foresight—enabling his institutions to consistently outperform competitors and set new industry benchmarks. His work has paved the way for future innovations, inspiring financial engineers worldwide to explore new frontiers in algorithmic trading and risk management.

Conclusion

The legacy of Dr. Glen Brown is a beacon of visionary leadership in financial engineering. By transforming theoretical models into practical, dynamic trading systems, he has reshaped the way markets are analyzed and trades are executed. His pioneering work with the GATS framework, adaptive risk management tools, and exclusive business model serves as a blueprint for the future of trading—where innovation, precision, and adaptability are the keys to sustained success.

As the financial landscape continues to evolve, the influence of Dr. Brown’s methodologies will remain a driving force behind the next generation of algorithmic trading systems. His commitment to excellence and continuous improvement sets a standard that not only defines his legacy but also illuminates the path for future advancements in financial engineering.

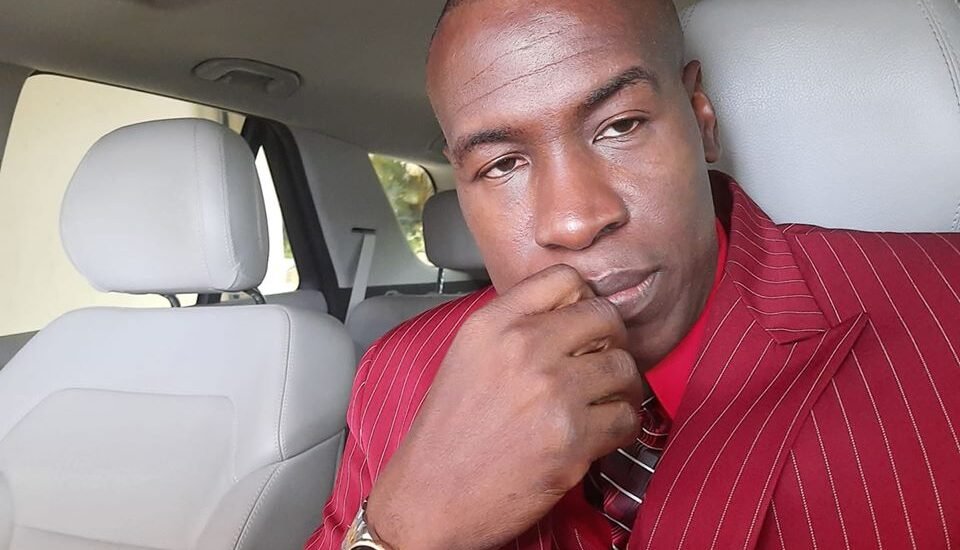

About the Author

Dr. Glen Brown is a visionary in financial engineering and algorithmic trading. With decades of experience bridging theoretical models with practical trading applications, Dr. Brown has pioneered innovative frameworks that adapt dynamically to market conditions. As the founder of Global Accountancy Institute, Inc. (GAI) and Global Financial Engineering, Inc. (GFE), his work with the GATS framework has set new standards in risk management and multi-timeframe analysis.

General Risk Disclaimer

The information presented in this article is for educational and informational purposes only and should not be construed as investment advice. Trading in financial markets involves risk, and past performance is not indicative of future results. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Global Accountancy Institute, Inc. (GAI) and Global Financial Engineering, Inc. (GFE) operate as a closed proprietary firm. We do not offer any products or services to the general public, nor do we accept clients or external funds. All methodologies, including the GATS Framework, are exclusively developed and utilized internally as part of our proprietary trading systems.

Neither the author, Dr. Glen Brown, nor his affiliated institutions (GAI and GFE) accept any responsibility for any loss or damage incurred as a result of the use or application of the information provided.